By James D. Roumeliotis

According to the Cruise Lines International Association (CLIA), the world’s largest cruise industry trade organization, the industry transported and hosted 30 million passengers in 2019 worth upwards of $117 billion in 2017. Traffic, since 2009, grew from 17.8 million with an annual growth rate of 5.4%.

Cruise ships, prior to the recent coronavirus pandemic, maintained a degree of glamour and opulence. Slick advertising and marketing projected images of fun and carefree times with a glorified onboard experience ─ a floating and carefree hotel resort. However, the dark side is best described as an industry which is rogue, careless along with insensitive behavior in international waters. According to a Conde Nast Traveler article, despite a relatively good safety record, the four most common cruise ship mishaps (icebergs is not one of them) are: Rough waves, storms, fires and collisions.

For the record, as a former yacht and passenger ship broker, who chartered entire ships to VIPs and for corporate events, this author possesses first-hand experience in the industry.

The Good…

To be fair, the safety aspect of passenger ships (specifically for those carrying more than 12 passengers) is regulated by the IMO (International Maritime Organization) and its convention known as SOLAS (Safety of Life at Sea). It regulates basic safety aspects for ships on international voyages such as stability, machinery, electrical installations, fire protection and lifesaving appliances. The main objective of the SOLAS Convention is to specify minimum standards for the construction, equipment and operation of ships. In addition, cruise ships are required to adhere to:

- MARPOL (short for Maritime Pollution): It is the main international convention aimed at the prevention of pollution from ships caused by operational or accidental causes. It was also adopted at the IMO (International Maritime Organization). For cruise ships it includes pollution by sewage pollution by garbage.

- Classification Society: It is a non-governmental organization that establishes and maintains technical standards for the construction and operation of all categories of ships, as well as offshore structures such as an oil platform and offshore platform… in accordance with the published standards. Classification Societies certify that the construction of a ship complies with pertinent standards and perform regular surveys in service to ensure continuing compliance with the mandatory standards. A classification society’s workforce comprises of ship surveyors, mechanical engineers, material engineers, piping engineers, and electrical engineers.

…The Bad and the Ugly

The best way to describe the typical cruise experience is: cruise ship passengers (or guests as they are normally referred to) get ferried from port-to-port on a floating amusement park. However, as recent events have indicated, cruise ships with their confined spaces and close living quarters are ideal for various diseases including novel viruses such as Covid-19 as they may increase the amount of group contact. In addition, people joining the ship may bring the virus to other passengers and crew. ‘Stranded at sea’: cruise ships around the world are adrift as ports turn them away, read the unflattering headline (March 27, 2020) at The Guardian, an established British daily newspaper.

Passenger ships can also be categorized as high-risk, with excessive sexual assault rates, frequent poisonings, and the ever-present possibility of falling overboard. Cruise ships are also infamous for the environment through their deliberate and/or careless disposal of sewage ─ and air pollution caused by their engines and generators burning away tons of heavy diesel fuel.

Although their head-offices are based in countries such as the U.S., the U.K. and other countries in Europe, cruise lines typically register their ships under so-called “flags of convenience.” The most popular countries with shipping registries include the Bahamas, Panama, Bermuda, Liberia and Malta. Those are chosen for their cheap registration fees, low wages, loose regulations and to take advantage of a taxation loophole that essentially shields them from paying any income tax in the countries the cruise liners are actually based and operate. Although the IMO (International Maritime Organization) makes the international rules that govern shipping, including the sea cruising sector, it has no enforcement power.

As for wages, the stark reality for many cruise ship workers is far from glamour work and pay to match. While the working conditions for officers such as the captain and his lower ranking bridge staff, as well as those working in the shops and casinos are adequate, if not better, the experience of those working in the dining room, in the galley, cleaning rooms, and below deck describes a different story. Those workers are often paid substandard wages, survive on inadequate food, have marginal accommodations ─ and basic medical care for injuries can be scant. Those employees also live under a system that is widespread with abuse and uncertainty. Cruise lines can get away with treating their lowest-paid workers poorly because they recruit them from countries with limited economic opportunities. In other words, people who either don’t know any better and/or see a cruise ship job as a better employment opportunity than what is available in their country.

In March 2019 the cruise ship Viking Sky, with More than 890 people onboard, experienced a loss of engine power off the coast of Norway near Molde. Unable to steer without power, the ship kept getting slammed by extreme waves. Consequently, passengers’ belongings were scattered everywhere in their cabins. The captain declared an emergency. Passengers put on life jackets and went to the muster stations. Eventually, evacuation began. Rescuers worked all night to airlift more than 400 passengers (about half the total) to shore by a fleet of five helicopters flying in the dark, slowly winching people up one-by-one from the heaving ship as the waves crashed and the winds shrieked. The ship, aided by tow vessels, eventually wobbled into the Norwegian port of Molde freeing the remaining 436 passengers and crew of 458.

In 2013, an engine fire aboard the “Carnival Triumph” left its 4,000 passengers adrift with neither any power, nor running water and scarce food. A year later, Royal Caribbean International was bestowed with the unflattering distinction of breaking the record for the largest number of passengers ill onboard its ship from a norovirus plague — nearly 700 people.

In 2019, the behemoth cruise line Carnival Corporation and its Princess Cruise Lines subsidiary agreed to pay a criminal penalty of $20 million for environmental violations such as dumping plastic waste into the ocean. Princess had previously paid $40 million over other deliberate acts of pollution. Royal Caribbean Cruises, the world’s second largest cruise line, has paid an $18 million fine for illegally dumping a great deal of waste oil and chemicals into U.S. waters from its dry cleaning shops and its printing and photo processing equipment. Moreover, the crew lied to the U.S. coast guard when asked about the slicks trailing its ships. Other companies have also paid high fines for causing environmental damage.

Cruise ships also leave a tremendous amount of environmental footprint. In a year, 100 million gallons of petroleum products from the ships seep into the oceans. Then there’s the air pollution they create. They burn as much fuel as entire small towns and operate on low Sulphur fuel which is 100 times worse than road vehicle diesel.

In June 2019, the 13-deck MSC Opera cruise ship with over 2600 passengers onboard, crashed into a tourist boat and then into a dock in Venice, Italy, due to an engine failure. Video posted to social media showed passengers escaping from the tourist boat and frantically rushing down the dock as the cruise ship swiftly approached them.

Bailout Expectations

Sadly, cruise liners with no obvious plan in place were taken by surprise (reactive vs. proactive). As a result, they mishandled the coronavirus onboard their ships ─ beginning with the outbreak on the Diamond Princess in Yokohama, Japan. Seven hundred people on board were infected with COVID-19 spreading through the ship’s corridors during its two weeks of quarantine, leading to seven deaths. According to passengers aboard the vessels, as well as outcry from health experts, in the weeks following the outbreak major cruise lines missed several opportunities to mitigate the crisis. Furthermore, according to one cruise line spokesperson, to avoid a panic that might collapse the industry, the cruise lines continued to mislead their passengers.

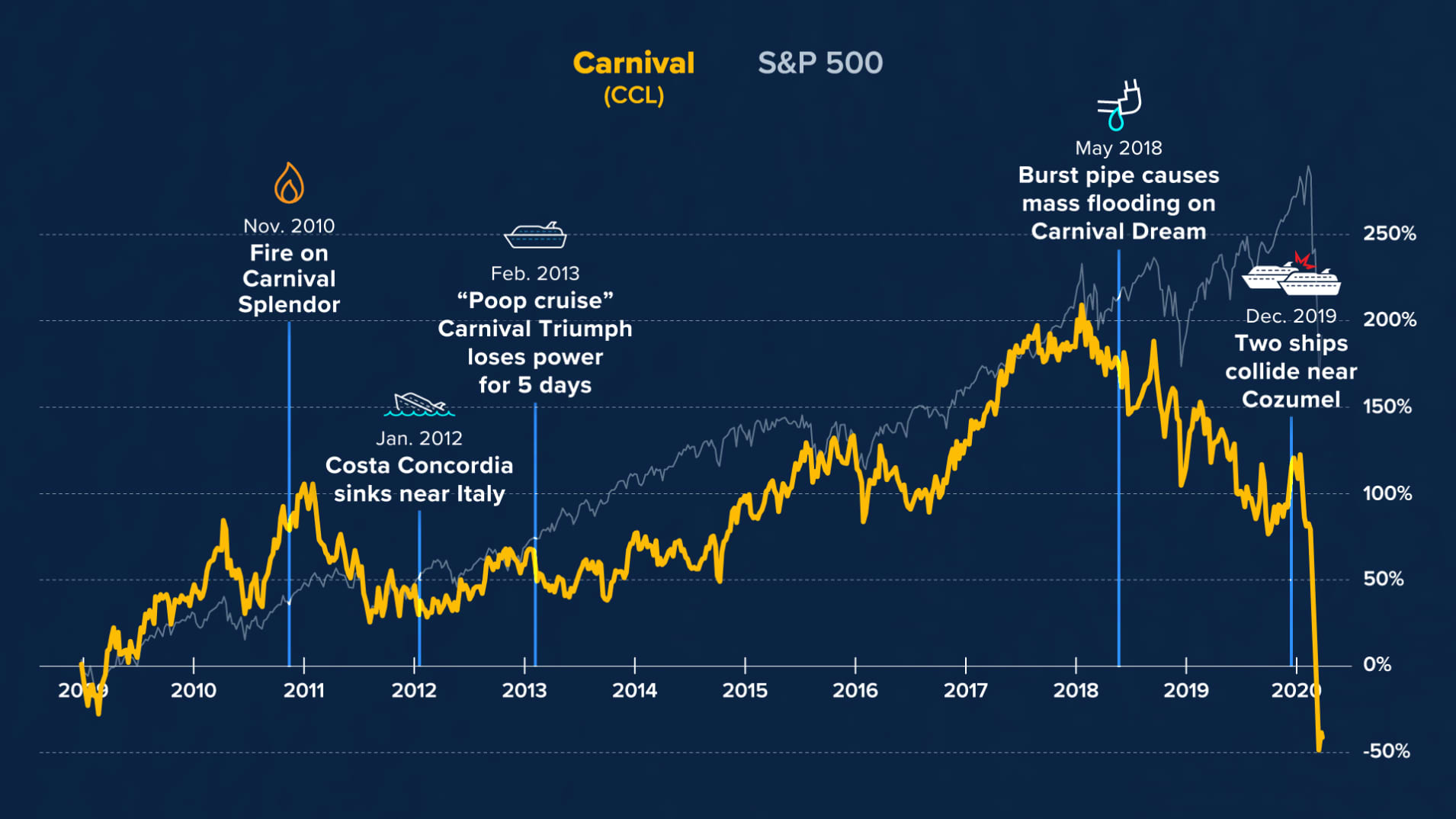

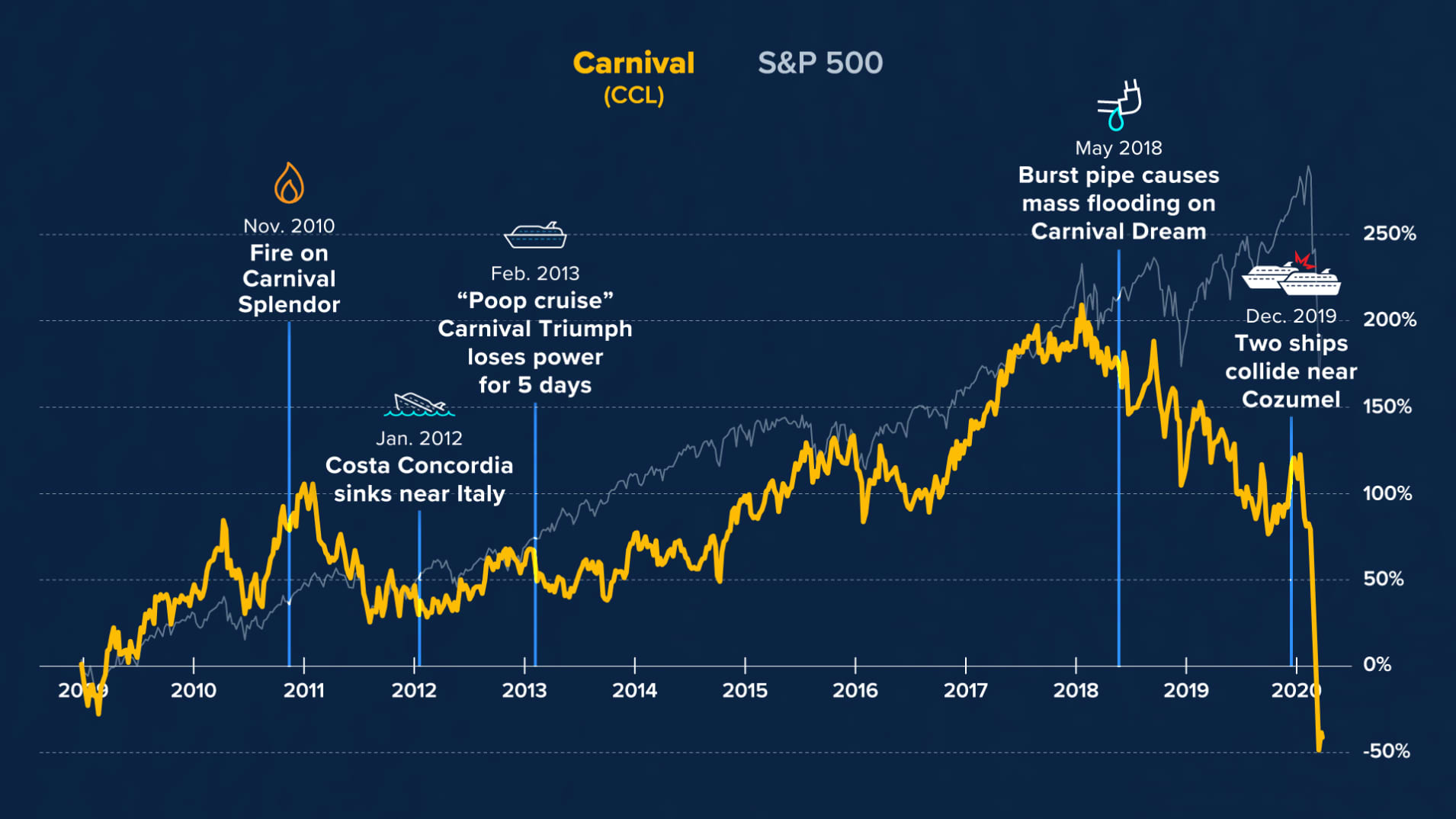

As expected, the news of the Covid-19, especially with many more cruise ships involved, caused a wave of cancellations and stock prices dropped significantly. Shares in Carnival, the world’s largest cruise line with several subsidiary brands in its portfolio, as well as its major competitors Royal Caribbean and Norwegian, have lost more than half of their value thus far this year. To reassure passengers, the Cruise Lines International Association (CLIA), which represents 90 percent of cruise liners worldwide, has issued sweeping restrictions and safety measures to be followed on ships. That reactive approach is too little too late and won’t make much of a difference in terms of reassuring booked passengers and potential ones.

The mere talk to inject billions to prop-up the cruise sector devastated by the pandemic, governments need to take this opportunity to come with strings attached such as implementing provisions, and by creating and enforcing legislation on the cruise ship industry to change its intolerable practices. If the industry along with its annoying lobbyists and greedy executives begin to balk, it will be time to take a hatchet and push the repulsive cruise line operators out to sea. Peter DeFazio, a Democrat in the State of Oregon and chairman of the Transportation Committee, firmly declared that he has no desire to bail-out the cruise industry. “They aren’t American,” he said. “They don’t pay taxes in the United States of America. If they want to re-flag their ships and pay U.S. wages and pay U.S. taxes, then maybe.” Other U.S. House Representatives echoed similar sentiments.

Alas, the mischievous cruise industry (the major ones are Royal Caribbean, Carnival Cruise Lines, and Norwegian Cruise Line Holdings) which insists on self-policing yet retains many holes in regulation and insulates itself by registering its ships in foreign countries (i.e. “Flags of convenience”). Add to that its powerful lobby (spend approximately $3 M annually on lobbying) in the nation’s capital along with strong influence mainly in the tourism-dependent state of Florida.

In the End

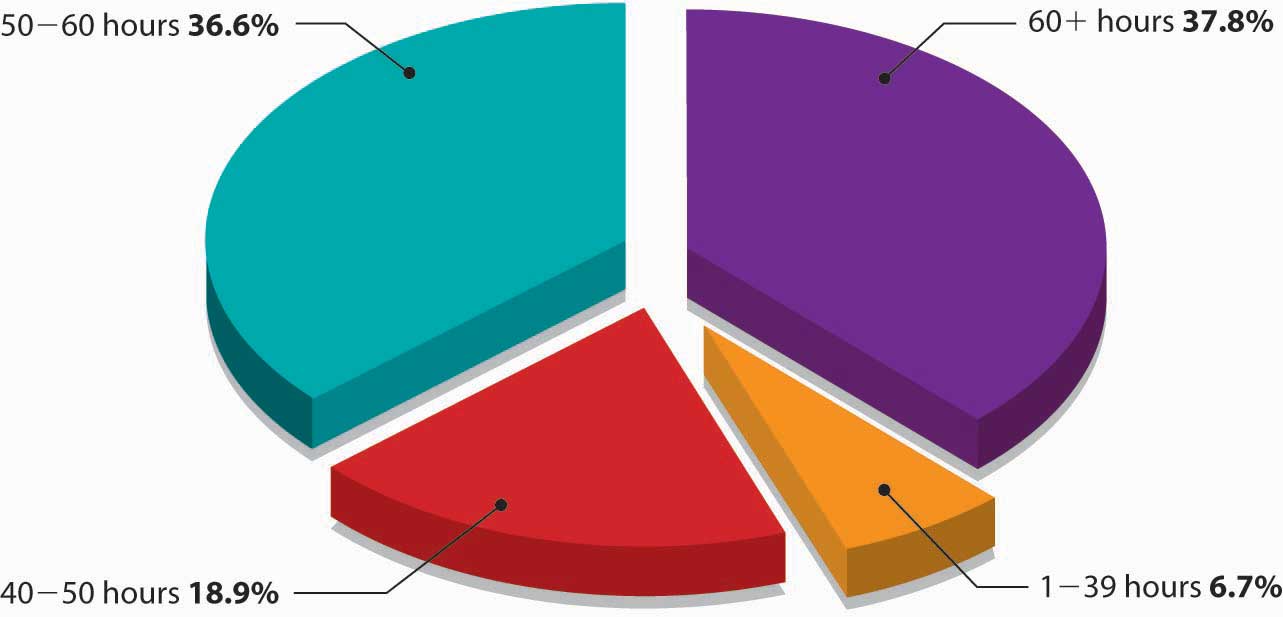

The cruise industry has few fans at this time with many more losing interest. In addition, the elderly, are especially steering away of such voyages ─ perhaps for good. According to the Cruise Lines International Association (CLIA) Global Passenger Report, the median age has been between 60 and 69-year-olds, with a full 19% of cruisers falling under this demographic.

The only exception to the cruise industry worth applauding, with its premium ships, sustainable and exceptional consistent experiences, are the small luxury cruise vessels or boutique ships ─ many which resemble a yacht-like intimate atmosphere with accommodations for between 50 and 600 or so passengers along with a one-to-one ratio of crew members to passengers. Some top rated examples include Ponant Yacht Cruises & Expeditions, Variety Cruises, Seadream Yacht Club, Windstar Cruises, Silversea, Seabourn, and the recent newcomer Ritz–Carlton with its first-ever yacht christened Evrima accommodating up to 289 guests.

Disappointing pictures of what the mainstream massive cruise ships actually look like in the real world (glamour vs. reality) can be viewed at this link.

For all known illness outbreaks and additional unique news on cruise ships, refer to Cruise Junkie, an online information resource which tracks disasters at sea on the website based on news, passenger, and official accounts.

A full documentary of the cruise ship industry gone awry is linked here.

Finally, for some satire about the cruise industry by HBO comedian Bill Maher, click here for the link to the segment.

______________________________________________

Request your TWO FREE chapters of this popular book with no obligation.